Median resale prices top S$1 million for 4-room HDB flats in three towns in Q2

Overall resale flat prices continue to moderate in the quarter with 0.9% rise

[SINGAPORE] While the overall growth in HDB resale flat prices continued to moderate in the second quarter of 2025, median resale prices for four-room flats crossed the million-dollar mark in the Central Area, Toa Payoh and Queenstown.

This is the first time median prices of four-room flats measured on a quarterly basis have hit S$1 million, said Wong Siew Ying, head of research and content for PropNex Realty.

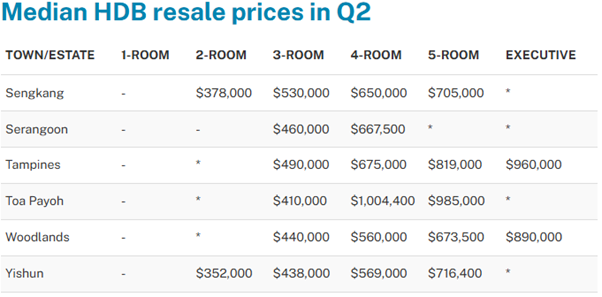

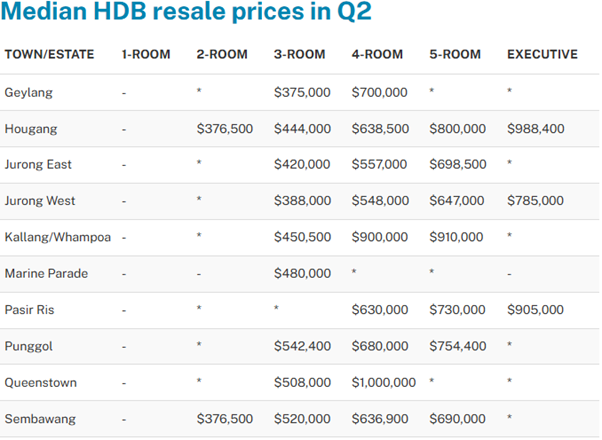

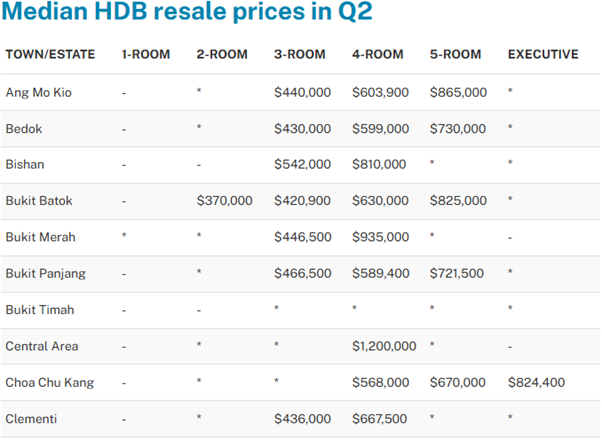

– Indicates no resale transactions in the quarter.

* Refer to cases where there are less than 20 resale transactions in the quarter for the particular town and flat type. The median prices of these cases are not shown as they may not be representative.

Source: HDB

GRAPHIC: CHARMAINE MARTIN, BT

Median resale prices for four-room flats in the Central Area stood at S$1.2 million in Q2, based on quarterly data released by the Housing & Development Board (HDB) on Friday (Jul 25).

There were 11 four-room flats in the Central Area sold for over S$1 million in Q2 and all of them were in the Pinnacle@ Duxton project, said PropNex’s Wong.

In Toa Payoh, the median resale price of four-room flats stood at S$1.004 million; the median for four-room flats in Queenstown was S$1 million.

For Toa Payoh, 52 four-room flats tipped into the million-dollar range, mainly propped up by transactions at projects in Bidadari Park Drive and Alkaff Crescent which have recently obtained MOP, according to PropNex data.

In Queenstown, 33 four-room flats were sold for S$1 million and above, including units that had reached the minimum occupation period (MOP) in Strathmore Avenue and Dawson Road.

Median resale prices of five-room flats in two towns are also approaching the S$1 million mark. Five-room flats in Toa Payoh had a median resale price of S$985,000 in Q2. In Kallang-Whampoa, the median resale price of flats in the same period was S$910,000.

For the second quarter, the total number of million-dollar flats hit a record 415, almost 20 per cent higher than in Q1, said Lee Sze Teck, Huttons Asia’s senior director of data analytics.

The rising numbers reflect “growing demand for newer, well-located flats, especially those that have just reached their MOP and offer longer remaining leases”, said Mohan Sandrasegeran, head of research & data analytics, SRI.

However, most HDB flats remained affordable, with 78 per cent of all transacted HDB flats in the quarter falling under the S$750,000 mark, said Eugene Lim, ERA’s key executive officer.

Overall resale prices for public housing flats rose 0.9 per cent in the second quarter – the smallest quarter-on-quarter increase since Q2 2020.

This is the third consecutive quarter in which growth in prices has moderated, after having risen 1.6 per cent in the first quarter of the year, HDB said. Year on year, prices rose 8 per cent.

Transaction volumes of resale flats rose 7.8 per cent in Q2 to 7,102 units, from 6,590 units in the previous quarter. Year on year, there was a 3.4 per cent dip in units sold.

The number of approved applications to rent out HDB flats rose 4.2 per cent to 10,066. This was 5.4 per cent higher on a yearly basis.

Some 58,720 HDB flats were rented out at the end of the second quarter – a 1.4 per cent decrease from the first quarter.

The highest median rental price was S$4,400 for five-room flats in Queenstown and for four-room flats in the Central Area; the lowest median rental price was for two-roomers in Sengkang at S$2,250.

HDB approved 10,066 cases to rent out the flats – a 4.2 per cent jump quarter on quarter and 5.4 per cent rise year on year.

In October, HDB will launch about 9,100 Build-To-Order (BTO) flats in Ang Mo Kio, Bedok, Bishan, Bukit Merah, Jurong East, Sengkang, Toa Payoh and Yishun. These will include the first flats in the Greater Southern Waterfront and Mount Pleasant, and community-care apartments will also be on offer in Sengkang.

The upcoming BTO exercise may provide some relief to the HDB resale market, said Huttons’ Lee. The market has experienced some tightness in supply, as only around 6,974 resale flats are expected to fulfil their MOP and hit the market in 2025, the lowest since 2014.

For the full year, Lee expects some 26,000 to 28,000 resale flats to be sold, with prices likely to grow between 4 and 6 per cent.

PropNex’s Wong said: “We expect moderate price gains in the HDB resale flat segment in the second half of the year, as several factors may potentially weigh on prices. These include existing cooling measures (lowered loan-to-value limit at 75 per cent for HDB home loans), affordability concerns and price resistance among buyers, and competing supply in the form of new BTO flats with shorter waiting times and Sale of Balance Flats that are either completed or close to completion.”

Source: https://www.businesstimes.com.sg/property/median-resale-prices-top-s1-million-4-room-hdb-flats-three-towns-q2

Leave a Reply